How To Get Custom Debit Cards

Table Of Content

You’ll likely receive instructions from Wells Fargo on how to activate your new card once it arrives. If your checked or carry-on luggage is lost or stolen during transit, you’re covered for up to $3,000 per trip. Additionally, your rental car is protected against damage or theft with secondary rental car insurance. The card also comes with up to $1,000,000 in travel accident insurance, travel and emergency services assistance, roadside dispatch and more. People who love to travel can maximize their rewards with the Autograph Journey Card.

What should I do if Wells Fargo does not approve my customization?

We’ll also need some basic information about anyone who owns 25% or more of the business including name, address and SSN or other government issued ID number. Now you can get more done with your digital wallet.Footnote 1 Learn more about digital wallets or how to add your card. If metal isn't a necessity, you can consider the rest of the best Citi credit cards. Otherwise, there are plenty of other metal credit cards to check out from other issuers. Track each purchase and payment with your debit card using My Spending Report our online money management tool. Certain devices are eligible to enable fingerprint sign-on.

Digital Wallets

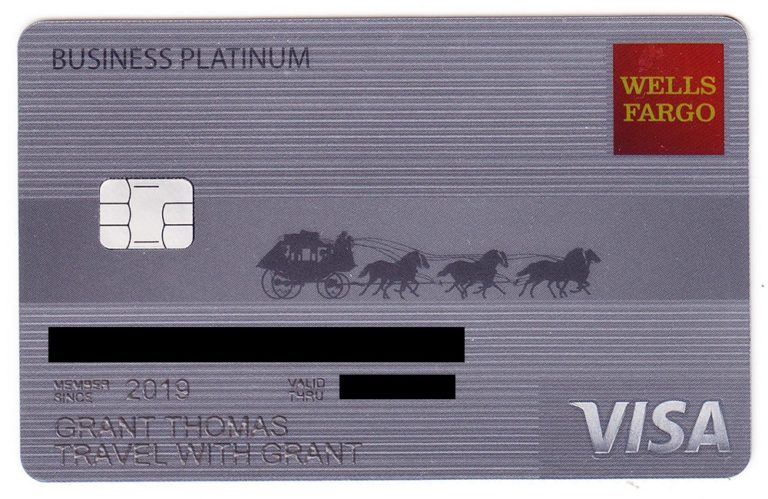

Since the Wells Fargo app doesn’t currently offer debit card customization, you’ll need to head over to their website. While the Wells Fargo Autograph Journey has much to offer, it may not be the right card for every traveler. Wells Fargo intends to add more transfer partners over time, but some consumers may not want to wait that long or roll the dice that new partners will be among their preferred brands. Wells Fargo will review your customizations and image selection then send you an email within approximately 2 business days to let you know if your design is approved. Once approved, your new card should arrive in approximately 5-7 calendar days.

Redeem for gift cards

While the card has a $95 annual fee, it is offset by its yearly $50 credit toward airline purchases. Simply book flights of $50 or more to automatically receive the statement credit on your next bill. The card’s complimentary travel protections and cell phone insurance also provide peace of mind for frequent travelers and people whose cell phone is an indispensable part of their daily lives. Each year, you’ll receive a statement credit of $50 when you make an airline purchase of $50 or more. Unlike some airline credits, these can be used to buy airfare as well—and you don’t have to choose an airline ahead of time. Qualifying purchases include airfare, upgrades, checked baggage, change fees and more.

How do I report a lost or stolen debit or ATM card?

You can contact your service provider directly to schedule, cancel, or change a one-time or recurring payment. You will need your billing account and your debit card information to set up payments. You will receive a new card with a new expiration date and security code (on back of card) within 5 to 7 calendar days.

How can I make sure the file I’m uploading meets the file format, file size, and pixel dimension guidelines?

A personalized debit card has a custom image or design chosen by the cardholder, while a non-personalized debit card has the standard bank-issued design. There’s no official word on why the app doesn’t offer debit card customization yet. However, it’s possible they’re working on integrating this feature in the future.

With self-service ATMs, Wells Fargo thinks big to build small - ATM Marketplace

With self-service ATMs, Wells Fargo thinks big to build small.

Posted: Thu, 18 Apr 2013 07:00:00 GMT [source]

Opinions expressed here are the author’s and/or WalletHub editors'. WalletHub editorial content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any company. In addition, it is not any company’s responsibility to ensure all questions are answered. Yes, activating your debit card as soon as you receive it in the mail is a necessary step for you to use your card, and an important step to help protect yourself from fraud. Stay informed of your card activity by enrolling in Wells Fargo Online®, and setting up debit card alerts to track your purchases and ATM withdrawals.

What do I do if I find a suspicious transaction on my account?

This card’s bonus categories target the areas where travelers spend the most—flights, hotels, dining and other travel purchases. Wells Fargo Private Bank offers products and services through Wells Fargo Bank, N.A., Member FDIC and its various affiliates and subsidiaries. Your bonus offer code will be automatically applied to your Clear Access Banking account when you complete your online application from this offer webpage. To customize the design of your card, simply select the design option you wish to use then follow the provided step-by-step instructions. To request a Campus Debit Card, you must visit a Wells Fargo branch in the state where your school is located. For the Campus ATM Card, you can link your school ID to a new or existing Wells Fargo checking account at any Wells Fargo branch.

What do I need to use a digital wallet?

You will be reimbursed for any unauthorized card transactions when reported promptly. An ATM card provides access to cash and other banking services at ATMs, and can be used to make purchases using a PIN. There is a daily maximum limit on the dollar amount of the purchases you can make with your debit or ATM card. Your card also has a maximum limit on the dollar amount of cash withdrawals you can make. Your purchases and ATM withdrawals also are subject to the available balance in your account. We provide you your daily ATM withdrawal and purchase limits when you receive your Card.

This card allows you to book directly with airlines, hotels and other travel providers to earn credit card rewards and perks from the loyalty programs. As a new cardholder, you can earn 60,000 bonus points by spending at least $4,000 on purchases within the first three months. These points are worth $600 toward travel and have numerous redemption options, including booking flights and hotels, getting cash back or buying gift cards. Wells Fargo also introduced transfer partners in April 2024, so you can transfer points to airlines and hotels to book award reservations worth potentially even more. Most Chase credit card designs are a default theme given to every customer who’s approved.

When you insert your card into a chip-enabled terminal, or when you tap your debit card at a merchant terminal or Wells Fargo ATM, a unique security code is generated. This makes it extremely difficult for anyone to reuse your information and better protects you against counterfeit card fraud. A Wells Fargo debit card is a contactless chip card allowing you to tap your card against a reader, in addition to inserting or swiping your card. You will receive a new or replacement card within 5 to 7 calendar days.

Comments

Post a Comment